is a car an asset for medicaid

Can I own a car and qualify for Medicaid. Because Medicaid is a needs-based program you must pass the income and asset eligibility requirements.

Benefit Or Backfire Navigating The Irrevocable Medicaid Trust

However the older vehicles may be included if the vehicle is 1.

. Department of Health and Human Services explains what types of assets are typically counted for purposes of determining Medicaid eligibility and what kinds of assets are not. Other vehicles are generally considered extra unless they are very damaged or undriveable. The state sets the income and resource limit each year.

Currently the Florida Medicaid policy is to exclude one car of any value or use. You have to be familiar with Medicaid in your state to know when not to buy a car while on Medicaid. She has Medicare and pays for supplemental coverage at approximately 240 a month.

A The answer is probably yes but it depends on the circumstances. However a Medicaid caseworker may consider an extravagant purchase an exotic or luxury car to be a investment and therefore a countable asset. My father in law is in a nursing home in Florida and has a Medicaid application pending.

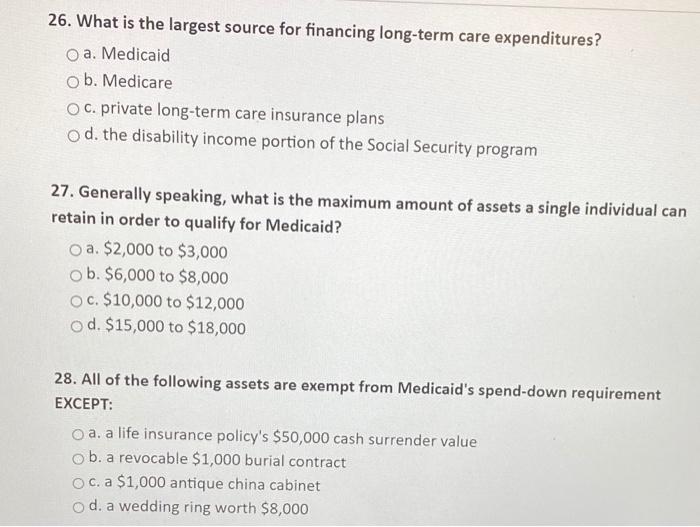

Discuss Medicaids Personal Service Contract and the purchase of a new car to avoid Medicaids spend down rules. You can also exempt a second vehicle older than seven years old unless it is a luxury vehicle or it is an antique or classic car older than 25 years old. About Medicaids countable assets and discuss what assets to transfer to reduce the amount of spend down of assets.

However for Medicaid eligibility there are many assets that are considered exempt non-countable. Grandma has zero assets her only income is social security which is 1201 a month. Generally Medicaid considers the value of any non-refundable pre-paid funeral plan or burial contract exempt.

Funeral and Burial Funds. Is this a countable asset at this point in the application process. Exemptions include personal belongings household furnishings an automobile irrevocable burial trusts and generally ones primary home.

What you can and cant keep with Medicaid. Keep in mind that your actions are subject to a 5 year Medicaid look back which means that you will be responsible for repaying the government for any assets that you gave a way with in 5 years of applying for Medicaid. Lets face it they are a necessity in life.

However when looking at applying for Medicaid this necessity may or may not be an asset we can keep. All of the countable assets are considered by Medicaid and it is largely these assets that can complicate Medicaid applications if not handled appropriately. Personal property is almost always an excluded asset so another way of spending down countable savings is by purchasing new personal items such as electronics and clothing.

Each state has separate Medicaid rules regarding countable assets and what is Medicaid excluded assets. This could even be a Lamborghini. According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value.

If you violate the rules of Medicaid your car will be counted as a countable asset. After the first vehicle of any value any vehicle more than 7 years old is not counted. And if the transaction is for fair market value and a fair interest rate there should be no transfer-of-asset issue if it is taken out within the five years before applying for Medicaid.

You can own an automobile and qualify for Medicaid. She doesnt have vision or dental as. However the reality could be more complicated and.

Medicaid also takes your vehicle into account as an asset and limits each Medicaid recipient to one non-countable vehicle in order to qualify. For 2021 New York automatically excludes applicants with assets above 15900 for an individual and 23400 for a family. This will result in eliminating the value of most vehicles over 7 years old.

His friend who hes lived with for years is his financial Durable POA. Can my mother gift her car to my daughter without worrying about the five-year look-back period if she applies for Medicaid. The short answer is that the mortgage is an asset and its value is the amount left to be paid on it not the original amount of the loan.

Your Medicaid coverage will be stopped because it shows you can pay for your healthcare cost yourself and you can be charged for fraud. A Medicaid client owning an automobile may have the vehicle exempt from being counted as an asset subject to the 2000 limitation on the total value of assets if. With this coverage she barely pays for any medical expenses.

State says she doesnt quality for Medicaid. This could even be a Lamborghini. If you own a car you can rest assured Medicaid is not going to hold it against you no matter how much it costs.

One automobile of any current market value is considered a non-countable asset for Medicaid purposes as long as it is used for the transportation of the applicant or another member of their household. She just had him sell his car to his brother for 6000 and had the check made to her rather than to my father in law. In addition to whether or not assets are countable or not there is a level of assets that are countable which would still be considered acceptable to qualify for Medicaid.

The state will increase Medicaids asset limit from 2000 for an individual to 130000 and from 3000 for a couple to 195000. A countable asset for Medicaid is a specific asset that counts towards your asset limit in determining if you can become eligible for means-tested Medicaid benefits or not. To keep this as basic as possible.

This means you can own one Bentley worth over 100000 and that vehicle would. Most of us own a vehicle. When it comes to Medicaid countable assets you could give them to your loved ones before you apply for Medicaid coverage.

Asset Protection And Unforeseen Costs To Prepare For John Ross Asset Protection Car Insurance Judgement C Umbrella Insurance Nursing Home Care Insurance

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/medicare-fa9c842eddfc4051bfe4397597c88fe9.jpg)

Medicaid Spend Down Strategies

Spending Down Assets To Qualify For Medicaid Elder Care Direction

![]()

On Medicaid Are You Legally Allowed To Have More Than 1 Car If You Want A Second Car Real Cheap From The Junkyard Agingcare Com

Ludicrous And Unhelpful Senate Republican Seeks To Restrict Snap And Medicaid In Ohio Ohio Capital Journal

California Removing Asset Test For Medicaid Eligibility

![]()

On Medicaid Are You Legally Allowed To Have More Than 1 Car If You Want A Second Car Real Cheap From The Junkyard Agingcare Com

Solved 6 All Of The Following Statements Regarding Chegg Com

Medicaid Qualification In Florida Hemness Faller Elder Law

Spending Down Assets For Masshealth The Heritage Law Center Llc

Tools For A Medicaid Spend Down Spratt Senior Planning

2022 Medicaid Numbers Hauptman And Hauptman Pc

Medicaid Planning Options For Elder Married Couples Affirmed In Landmark Michigan Court Cases

Can An Ira Affect Medicaid Eligibility

What Are Florida S Income And Asset Tests For Medicaid Benefits Seniordirectory Com